Use of financial is very important getting establishing a good economic designs and you can avoiding the higher costs tend to associated with the option economic features. When you find yourself starting a checking account is actually relatively simple, it does establish an issue having immigrants, also folks who are new to the us while having minimal English ability, together with people that enter the nation without paperwork.

Together, you’ll find forty-two.9 billion immigrants regarding the U.S., 10.step three million off just who try undocumented. Expertise financial legal rights is guarantee that immigrants can access the fresh banking products and services they want.

Trick Takeaways

- You’ll find a projected 44.nine million immigrants in the us, along with 10.3 million undocumented immigrants.

- Of a lot immigrants will most likely not know the banking rights or ideas on how to open a bank account, particularly when it do not have the called for documentation to accomplish this.

- Code traps also can prevent immigrants regarding seeking out brand new financial products they need to ideal would their cash.

- Being unaware of the financial rights could easily pricing immigrants many if you don’t several thousand dollars in the a lot of fees.

Bank account and you may Immigration Updates

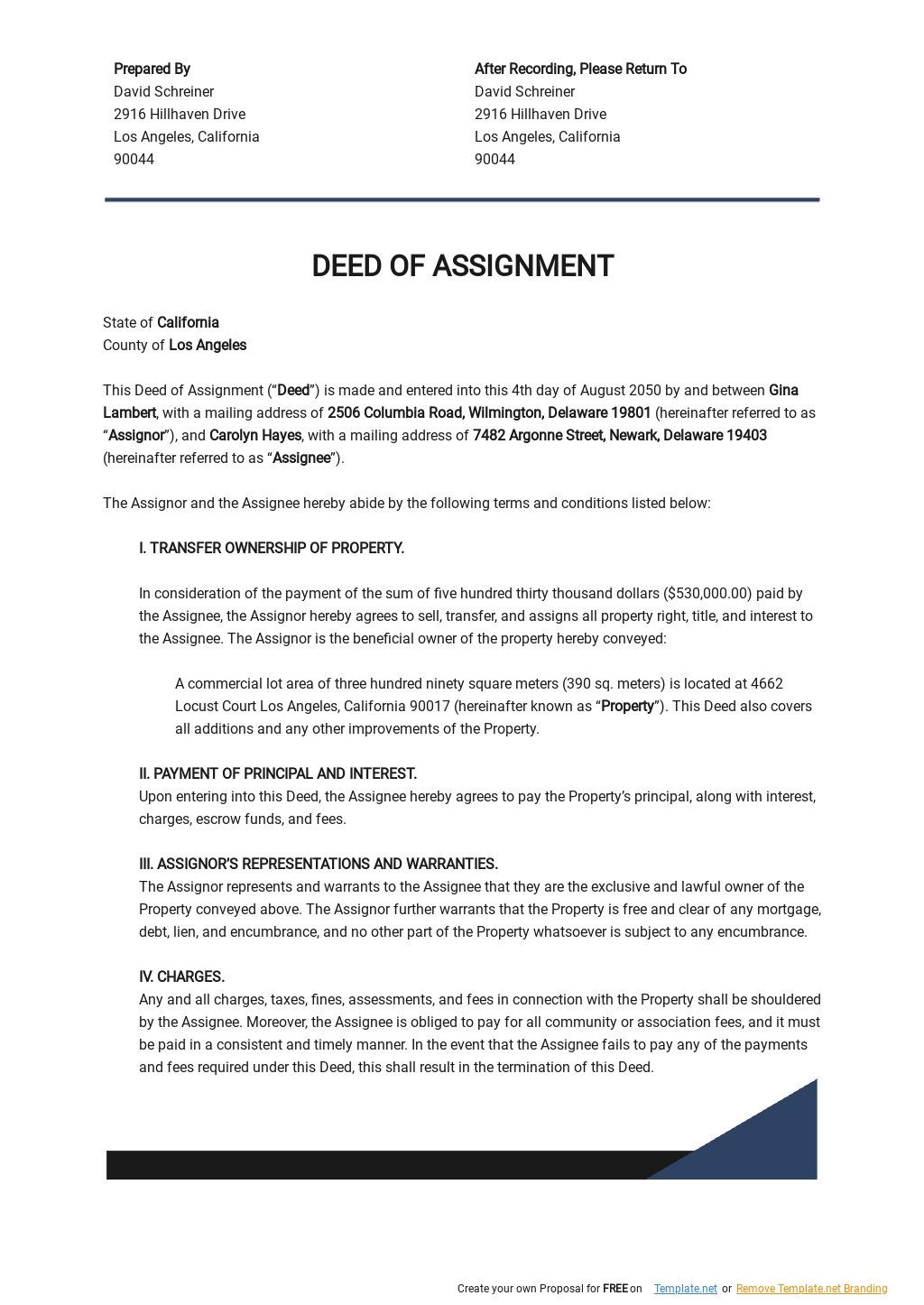

One of the most commonly expected inquiries you to definitely immigrants may have is if one may discover a bank account in place of an effective Public Protection count. This new short response is yes, one may score a checking account instead of a personal Protection matter whenever you give other designs of help records or personality. The average guidance one banks have to unlock a different sort of account are their:

- Identity

- Date off delivery

- Address

- Identification

Rather than a social Defense number, it’s possible to possess immigrants to open up a checking account using an Personal Taxpayer Personality Matter installment loans in Kingston (ITIN). It matter, granted because of the Irs (IRS), is designed for people that lack and generally are maybe not eligible for a personal Safeguards count. ITINs is actually issued aside from immigration updates and certainly will be used to open a checking account.

An enthusiastic ITIN does not approve that operate in the latest You.S., nor will it bring qualifications getting Public Security positives otherwise be considered a based upon to possess Received Tax Credit (EITC) intentions.

- A beneficial nonresident alien who has necessary to file an excellent You.S. income tax go back

Credit cards and you will Finance for Immigrants

Bringing credit cards otherwise mortgage will help satisfy monetary needs and can getting an easy way to present and build an excellent U.S. credit history. Immigrants feel the straight to sign up for loans and credit cards, and you can a great amount of banking institutions and you can lenders render her or him. You can find, but not, particular constraints and conditions.

For example, Deferred Step to possess Youthfulness Arrivals (DACA) recipients try ineligible for government student loan applications. not, they could to find private figuratively speaking from banking companies and other lenders, along with personal loans or automotive loans. Meanwhile, most other noncitizens may be able to efficiently sign up for government college student fund if they give sufficient documentation.

Specific Indigenous Western people created into the Canada that have a standing below the fresh Jay Pact from 1789 can be qualified to receive federal scholar support.

Certification to own personal college loans, personal loans, auto loans, or mortgages may vary of financial to help you financial. Such as, no verification off citizenship otherwise immigration condition may be needed if the the application form offer an ITIN and you may evidence of money. An excellent passport and other identity could be requested to do the borrowed funds application.

In terms of handmade cards wade, plenty of economic tech (fintech) organizations allow us borrowing facts especially for individuals who do not have a personal Cover amount. Candidates are able to use a keen ITIN rather locate accepted. If they are able to discover an account, capable following use one to to establish and construct a cards record, which can make they simpler to be eligible for loans.

Bulk are a mobile banking application designed for only immigrants one includes custom access to financial no overdraft charge or international deal costs.

Mortgage loans for Immigrants

To get a house usually form taking a home loan, and you may immigrants feel the to apply for a mortgage from the You.S. The biggest issue with taking approved is capable see brand new lender’s certification criteria for a career records, credit history, and you will proof of income. If you don’t have a credit rating on U.S., as an example, that can ensure it is more difficult to possess lenders to evaluate the creditworthiness.

Starting a bank account with a major international financial having U.S. twigs otherwise with a U.S. lender can assist you to introduce a monetary records. Once more, you could unlock a bank checking account with an ITIN, plus financial could possibly get allow you to get a mortgage using your ITIN also. Doing your research to compare mortgage solutions can help you get a hold of a bank which is prepared to help.

Offering a bigger downpayment make they easier to meet the requirements getting a home loan on U.S. when you yourself have immigrant condition.

Sure, you can legitimately discover a checking account regardless if you features a social Safeguards count and you may regardless of your immigration position. Enough banking institutions and borrowing from the bank unions accept a number of out of identification files, also a single Taxpayer Personality Count (ITIN), to open up a bank account.

What is an ITIN?

The inner Funds Provider (IRS) issues ITINs to people who are expected to file taxation statements and therefore are maybe not entitled to rating a social Defense amount. The fresh ITIN can be used instead of a personal Safety number whenever beginning a different family savings otherwise making an application for certain finance and you will handmade cards.

Perform I need to reveal immigration files to start a bank membership?

No. Finance companies and you may borrowing from the bank unions cannot ask you to confirm your own immigration standing to open up a bank checking account. If you believe one a bank or other lender try discriminating up against you predicated on your own immigration status, you can file an issue from the Federal Reserve System’s Individual Problem function online.

Is also unlawful immigrants has actually a bank account?

Sure, undocumented immigrants on the Us feel the right to unlock a checking account. Once again, financial institutions shouldn’t require that you show your own immigration reputation to discover an account.